THE WAYPOINT SUR

Just a small breather

The Freeze You Might Have Missed

On December 23rd, while most of Spain was buying turrón — nougat candy, and arguing about Christmas Eve seating arrangements, the Council of Ministers quietly confirmed something that affects every self-employed person in the country: autónomo — self-employed social security contributions will remain frozen at 2025 levels throughout 2026.

If you registered as autónomo to work remotely from Spain, or you run a small business here, your monthly cuota — social security payment isn't going up this year. The income-based contribution system, which was supposed to phase in starting January 1, has been delayed. Again.

This is good news. It is also temporary.

What the Freeze Actually Means

The Spanish government has been promising (or threatening, depending on your perspective) to move autónomos to an income-based contribution system since 2023. The idea: your monthly payment should reflect what you actually earn, not a flat rate you choose.

Under the original plan, 2026 was supposed to be the year contributions for higher earners increased. Instead, everything stays the same:

2026 Monthly Contributions (unchanged from 2025, confirmed January 2026)

Lowest income band (under €670/month net): €230/month Mid-range (€1,300-1,500/month net): €294/month Higher earners (€1,700-1,850/month net): €350/month Top band (€6,000+/month net): €530/month

The tarifa plana — flat-rate starter discount — also remains: €80/month for your first 12 months as a new autónomo, and €160/month for months 13-18 if your income stays below the minimum wage thresholds.

Why It Got Delayed

The official explanation involves "ongoing social dialogue" between the government, unions, and employer associations. The practical reality: implementing income-based contributions requires tracking actual earnings in near-real time, and neither the Agencia Tributaria — Spanish Tax Agency — nor Social Security has the systems fully in place.

The new timeline: full income-based contributions will be mandatory by 2032. That is six years away. But the infrastructure is being built now. VeriFactu — a digital invoicing verification system originally scheduled for January 2026 — has been pushed to July 2027 for autónomos. When it arrives, the tax authority will have real-time visibility into your invoicing.

The freeze is a delay, not a cancellation.

Who This Affects Most

If you structured your Spanish presence through self-employment on a Digital Nomad Visa, your monthly costs stay predictable for another year. The DNV income threshold (currently €3,024/month) is calculated separately from the autónomo bands, but if you earn €4,000-8,000/month, the income-based system would have increased your contributions.

If you invoice clients from Spain as an autónomo rather than through a Sociedad Limitada — limited company (SL), the math on your structure stays stable for 2026.

If you have been weighing the switch to SL, one argument for making the switch is the predictability of employment costs. With autónomo rates frozen, the urgency to restructure drops slightly. But only slightly. The 2032 system will hit high earners hard. (The full autónomo vs SL decision framework is here.)

What to Do With the Breathing Room

You have six years before the income-based system arrives. Here's how to use them:

Review your contribution band. You can adjust your base up or down quarterly. If your income dropped, you might be overpaying. If it increased significantly, you are building pension credits at a lower rate than you should. If someone in your household handles the gestor — tax advisor — relationship, this is a conversation worth having.

Model the 2032 impact. If you earn €5,000/month net, your contributions under the income-based system could exceed €500/month. That is real money. Understanding the gap now helps you plan.

Consider your structure. The autónomo vs SL decision involves social security, liability protection, hiring capacity, and how your costs flex with revenue. If you have been meaning to evaluate this, now is the time, while rates are stable. The Colegio de Gestores Administrativos de Málaga — Professional Association of Administrative Managers maintains a directory of registered practitioners at colegiogestoresmalaga.org.

Build reserves. Spanish autónomos have no employer to match their contributions. Your pension, unemployment protection, and disability coverage all come from that monthly cuota. If you are at the minimum band by choice rather than necessity, you are underinsuring yourself and your household.

The Timeline Ahead

2026: Contributions frozen at 2025 levels. No action required.

July 2027: VeriFactu mandatory for autónomos. Real-time invoice reporting begins.

2028-2031: Gradual phase-in of income-based adjustments (details TBD).

2032: Full income-based contribution system in effect.

Spanish-Lite

Two phrases for your next gestor conversation:

"¿Debo cambiar mi base de cotización?" — Should I change my contribution base?

"¿Cuánto pagaría con el nuevo sistema?" — How much would I pay under the new

The Bottom Line

Spain gave you a year. The autónomo contribution system, which was supposed to start tightening in 2026, has been pushed back, and your monthly cuota remains the same. This isn't a permanent reprieve. The income-based system is still coming, the infrastructure to track your earnings is being built, and 2032 will arrive faster than you think. Use the breathing room to optimize your structure, model your future costs, and make decisions while you still have options. The freeze is a gift. Spend it wisely.

Go deeper: The autónomo vs SL decision involves social security, liability, hiring, and how your expenses flex with revenue. If the 2032 projections have you reconsidering your structure, this is the framework.

Not bad for a Monday — A. and the fully contributed WaypointSur team

PS: Know someone who just registered as autónomo, or who has been meaning to review their contribution band? Forward this to them. They will get the same newsletter, free.

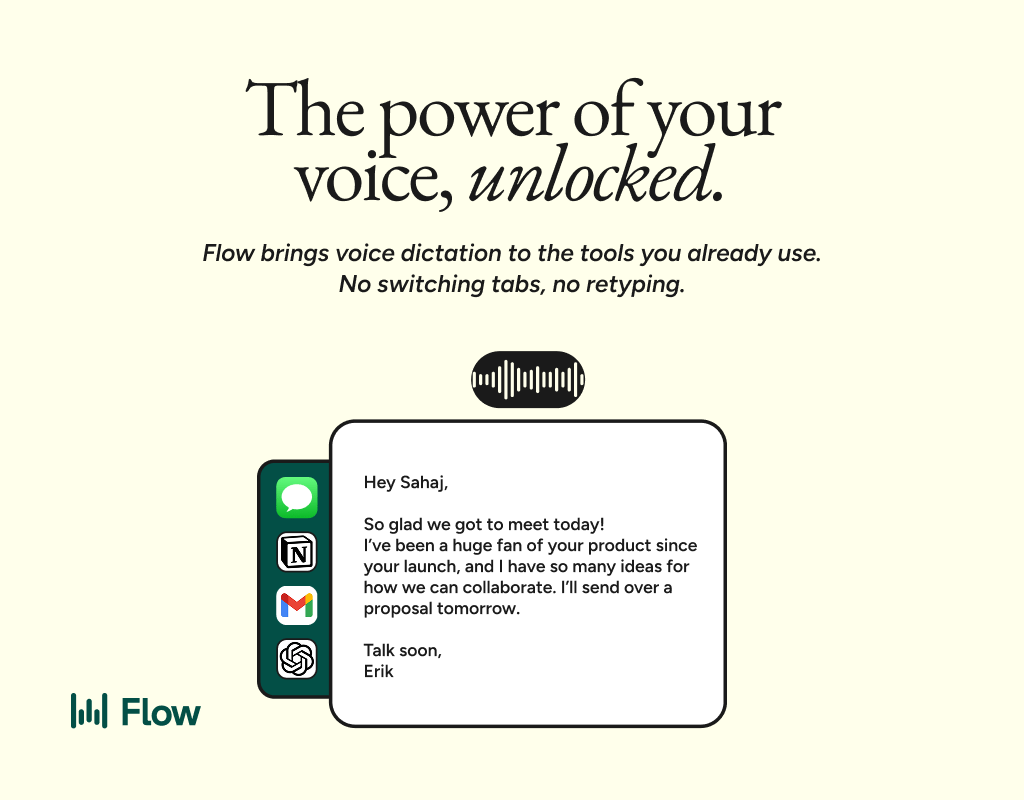

Better prompts. Better AI output.

AI gets smarter when your input is complete. Wispr Flow helps you think out loud and capture full context by voice, then turns that speech into a clean, structured prompt you can paste into ChatGPT, Claude, or any assistant. No more chopping up thoughts into typed paragraphs. Preserve constraints, examples, edge cases, and tone by speaking them once. The result is faster iteration, more precise outputs, and less time re-prompting. Try Wispr Flow for AI or see a 30-second demo.