Spanish Healthcare Costs in 2026:

The Real Numbers

The question nobody answers directly

How much does healthcare actually cost in Spain as an expat?You'll find plenty of articles saying "Spain has excellent healthcare" and "private insurance is affordable." But when you ask for numbers, you get vague ranges. When you ask which option is right for you, you get "it depends."Here's what it actually depends on, with actual numbers.

Your three options

If you're not Spanish and not employed by a Spanish company (which would give you access to the public system through social security), you have three paths:

Convenio especial — Buy into the Spanish public healthcare system

Private insurance — Standard international or Spanish health insurance

Pay as you go — No coverage, pay for each visit

Most expats end up with some combination. Here's how to think about each.

Option 1: Convenio Especial (buying into public healthcare)

The convenio especial lets non-working residents join the Spanish public healthcare system (Seguridad Social) by paying a monthly fee. You get the same coverage as a Spanish citizen who's never worked — which is to say, nearly everything except dental, optical, and some elective procedures.

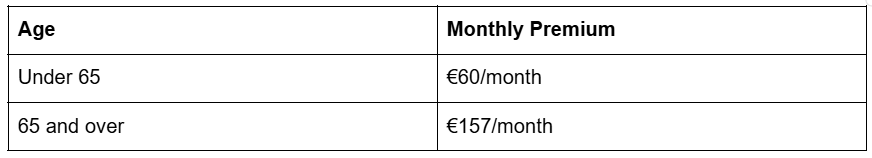

The costs (2026 rates)

Verified from Seguridad Social INSS official rates, January 2026.

That's €720/year if you're under 65. For two adults under 65, €1,440/year total.

What you get

GP visits at your local centro de salud — health center

Specialist referrals (cardiology, endocrinology, dermatology, etc.)

Hospital care and surgery

Emergency room access

Prescription medications at subsidized rates (typically 40% of cost)

Mental health services (though waitlists can be long)

Maternity and childbirth

Chronic disease management

What you don't get

Dental care (except extractions and some emergency procedures)

Optical care (eye exams covered, glasses not)

Elective cosmetic procedures

Some advanced fertility treatments

Anything while abroad (no international coverage)

The catch: The 1-year gap

You can only apply for convenio especial after being registered as a resident in Spain for at least one year. During that first year, you have no automatic public healthcare access unless you're employed (and paying into social security) or meet specific vulnerability criteria.This is the gap that catches people. You arrive, register on the padrón, get your TIE, and assume you have healthcare. You don't. Not automatically. Not for a year.

During the gap year, your options:

Private insurance (most common)

European Health Insurance Card (EHIC/GHIC) — only for temporary stays, not residence

Paying out of pocket

Emergency care (you always have access to urgent care regardless of status, but you may be billed afterward)

How to apply

After 12 months of continuous legal residence:

Book cita previa with INSS (National Social Security Institute)

Bring: TIE, passport, padrón certificate, bank details for direct debit

Complete application (Form TA.1 for convenio especial)

Wait 1-3 weeks for approval

Register at your local centro de salud with your new SIP card

INSS office in Málaga: Calle Hilera 6, 29007. Phone: 901 166 565.

Option 2: Private Health Insurance

Private insurance is faster (no waiting lists), more flexible (choose your doctor), and required for some visa applications (Digital Nomad Visa, for example). But it costs more, and understanding what you're buying matters.

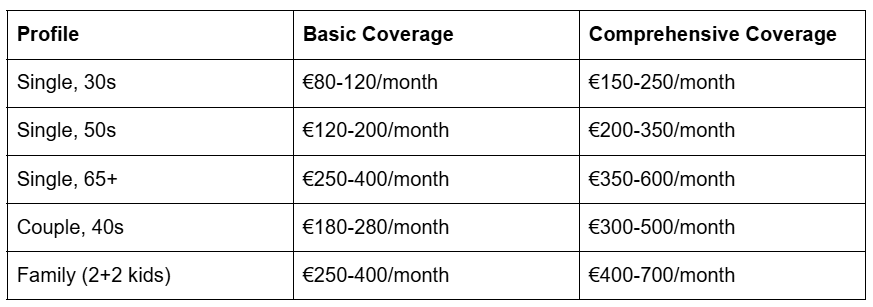

The cost ranges (2026)

Ranges reflect major Spanish insurers (Sanitas, Adeslas, Asisa, DKV). Verified January 2026.

What affects your premium:

Age (biggest factor — 65+ can be 3-4x the cost of 35)

Pre-existing conditions (some excluded, some with waiting periods)

Coverage level (basic vs. full hospitalization vs. international)

Deductibles and copays (lower premium = higher out-of-pocket)

Dental and optical add-ons

Spanish insurers vs. international

Spanish insurers (Sanitas, Adeslas, Asisa, DKV, Mapfre):

Lower cost

Larger local network

Policies in Spanish (though support increasingly in English)

Cover only Spain (some have EU add-ons)

Accepted for visa applications

International insurers (Cigna Global, Allianz Care, Bupa Global):

Higher cost (often 2-3x Spanish)

Smaller local network (you often pay upfront, claim back)

Policies and support in English

Cover globally or multi-country

Accepted for visa applications

For most expats settling in Spain long-term, Spanish insurers make more financial sense. Go international if you travel frequently or want worldwide coverage.

The pre-existing condition trap

Spanish insurers have carencias — waiting periods — for pre-existing conditions. If you have a history of back problems, expect 6-24 months before spinal procedures are covered. Diabetes? They may cover monitoring but exclude complications for a period.

The workaround: Some insurers offer "sin carencias" (no waiting period) policies for higher premiums. Others have shorter carencias if you can demonstrate continuous prior coverage.

Critical: Don't hide pre-existing conditions on your application. Insurers can and do deny claims if they discover undisclosed history.

Recommended insurers for English-speaking expats

Sanitas — Largest private hospital network in Spain. Good English support. Their "Más Salud" plans are popular with expats. Málaga office: Calle Martínez 4. Phone: 902 102 400.

Adeslas — Strong in Andalucía, competitive pricing. Their "Adeslas Completa" covers dental basics. Phone: 902 200 200.

Asisa — Cooperative model, good value. Less English support than Sanitas. Phone: 900 101 444.

Cigna Global — Best international option if you need worldwide coverage. Pricier but comprehensive. Phone: +44 1475 788 182.

Option 3: Pay as you go

Some expats — usually young, healthy, and comfortable with risk — skip insurance entirely and pay for care as needed. This is legal. Whether it's smart depends on your situation.

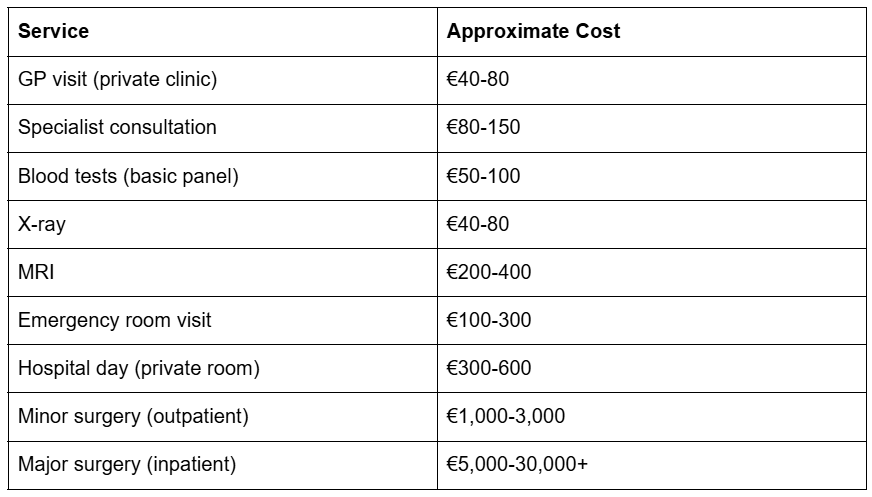

Private healthcare costs (paying out of pocket)

Ranges from major private clinics in Málaga province. Verified January 2026.

When this makes sense

You're under 40, healthy, no chronic conditions

You have substantial savings (€20,000+ accessible for emergencies)

You're only in Spain temporarily (under 1 year)

You have catastrophic/emergency-only coverage from home country

When this is risky

Any ongoing health conditions requiring regular care

Over 50 (health incidents become more likely and more expensive)

Family with children (kids get sick constantly)

You'd be financially devastated by a €15,000 surprise bill

The hybrid approach

Here's what many established expats actually do:

Year 1: Private insurance (required for visa anyway, covers the gap year)

Year 2+: Convenio especial (€60/month public coverage) + private dental plan (€15-30/month) + small emergency fund for private specialists if needed

Total Year 2+ cost: Roughly €100/month for comprehensive coverage that includes:

Public system for most care

Dental coverage for cleanings, fillings, extractions

Option to see private specialists when public waitlists are too long

Compare to €200-350/month for comprehensive private insurance with dental included.

The decision framework

Choose convenio especial if:

You've been resident for 1+ years

You're under 65 (price jumps significantly at 65)

You don't mind public system waitlists for non-urgent care

You want the lowest possible cost for solid coverage

You're fine adding private dental separately

Choose private insurance if:

You're in your first year (no choice for convenio)

You have pre-existing conditions requiring regular specialist care

You want zero waitlists for any procedure

You need English-language medical care

Your visa requires it (DNV, student visa, etc.)

You're over 65 (convenio becomes expensive, private more comparable)

Choose pay-as-you-go if:

You're young, healthy, and flush with savings

You're only here temporarily

You understand and accept the financial risk

Spanish-lite

At any health center or clinic:Quiero pedir cita con el médico de cabecera. — I want to make an appointment with the GP.¿Cuánto cuesta una consulta sin seguro? — How much does a consultation cost without insurance?

Gets you the information you need without a translator.

Common mistakes

Assuming you're covered: Legal residence doesn't automatically mean healthcare access. You need convenio especial, private insurance, or employer-provided social security coverage.

Ignoring the gap year: The first 12 months without coverage is when expats get caught. Get private insurance.

Choosing only on price: The cheapest insurance has the highest copays and smallest network. Look at what you'll actually pay when you use it.

Not checking the network: Before signing with an insurer, verify that hospitals and doctors near you are covered. Networks vary by province.

Hiding pre-existing conditions: They'll find out. Your claim will be denied. Be honest upfront.

The bottom line

Spanish healthcare is genuinely good — often better than expats expect from a country with lower costs. But "affordable" depends entirely on which path you take and which stage of life you're in. For most expats under 65, the math works out to:

Year 1: €120-250/month (private insurance)

Year 2+: €75-100/month (convenio especial + dental)

That's roughly €1,000-1,500/year for comprehensive healthcare once you're past the first year. Add private specialists as needed for an extra €100-500/year depending on usage. Compare that to €3,000-6,000/year for comprehensive private insurance maintained indefinitely. The convenio path pays off within 2-3 years. Do the work to get covered properly. The Spanish system is solid once you're in it. Getting in requires understanding which door to knock on.

Onwards — A

Last updated: January 2026

More guides: | |

Get weekly insights: