Autónomo vs SL: Which Spanish Business Structure in 2026

The €300/month questionThe first number everyone hears about being self-employed in Spain: €300/month in social security contributions. Before you've earned a euro.It's real. It's also not the whole story. And for many expats, it's not even the right comparison — because the question isn't "should I register as autónomo" but "which Spanish structure fits my situation."Here's how to think about it.

The two main paths

If you're working for yourself in Spain, you have two realistic options:

Autónomo — Self-employed individual. Simpler setup, simpler administration, direct taxation on your personal income.

Sociedad Limitada (SL) — Limited company. More complex setup, more administration, but potential tax advantages at higher incomes and liability protection.

There's a third option people try: keeping your UK Ltd or US LLC and pretending you're still based there. We'll get to why that doesn't work.

Autónomo: The default path

Autónomo — literally "autonomous" — is Spain's self-employment regime. You register with social security (Seguridad Social) and the tax agency (Hacienda), and you're in business.

2026 costs

Social security contributions:

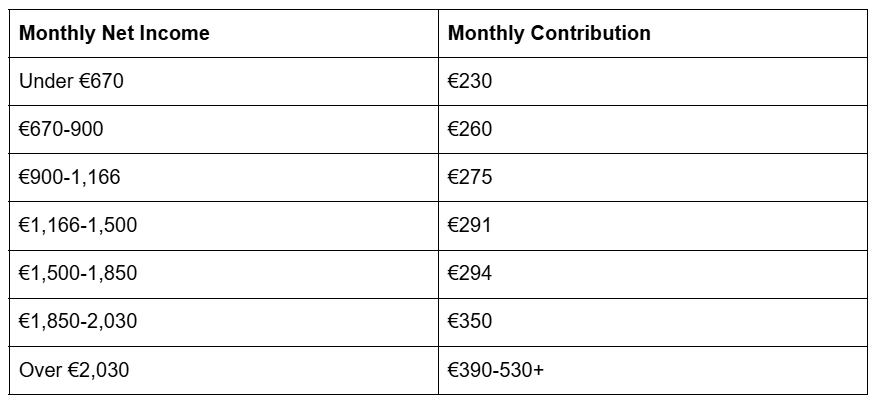

After the discount period ends, contributions scale with your declared income:

New progressive system introduced 2023, rates verified January 2026.What you get for those contributions:

Public healthcare (you're paying into social security)

Pension accrual

Sick leave coverage (after 4 days)

Maternity/paternity leave

Unemployment coverage (limited)

Income tax (IRPF)

Your profits get taxed progressively:

Plus any regional surcharge (Andalucía adds 0.5-3.5% depending on income).

The quarterly cycle

As autónomo, you file:

Modelo 130 — Quarterly income tax advance (20% of profit)

Modelo 303 — Quarterly VAT (IVA) if you charge it

Modelo 111 — Quarterly withholdings if you pay contractors

Modelo 100 — Annual income tax return (April-June)

Modelo 390 — Annual VAT summary

Most expats use a gestor — tax agent — for this. Budget €50-80/month for straightforward situations.

Sociedad Limitada (SL): The company path

An SL is a limited liability company — similar to a UK Ltd or US LLC in concept, though structurally different. You're an employee of your own company, which creates separation between business and personal income.

Setup costs

Ongoing costs

Before you've earned anything.

The tax math

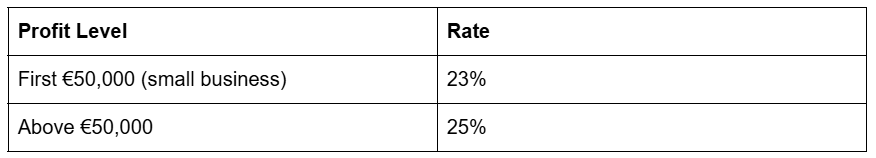

Company profits are taxed at corporate rates:

Reduced rate for first two years if certain conditions met: 15%.

But here's the thing: you still need to get money out of the company and into your personal account. That happens through:

Salary: Subject to income tax (IRPF) and social security — just like if you worked for someone else.

Dividends: Taxed at 19-26% depending on amount, plus the company already paid corporate tax on those profits. The combined effective rate (corporate + dividend) can end up higher than autónomo for moderate incomes.

The €40,000 inflection point

Here's the math that matters:

Below €40,000/year net profit: Autónomo almost always wins. Lower overhead, simpler administration, tax rates aren't punishing yet.

€40,000-60,000: Marginal. SL might save you money depending on how you structure salary vs. dividends. Probably not enough to justify the added complexity unless you need liability protection.

Above €60,000: SL becomes interesting. You can cap your personal salary (and therefore high IRPF brackets), retain profit in the company at 23-25%, and withdraw via dividends over time.

Above €100,000: SL is usually better structurally. The 45%+ personal tax rates for autónomos at this level make corporate structuring worth the overhead.

Three case studies

Case 1: Remote freelancer earning €35,000/year

Autónomo:

Social security: €275/month × 12 = €3,300

Income tax (rough): €5,500

Gestor: €75/month × 12 = €900

Total tax + costs: ~€9,700

Take-home: ~€25,300

SL:

Minimum overhead: €600/month × 12 = €7,200

Corporate tax + personal tax on salary: ~€6,000

Total tax + costs: ~€13,200

Take-home: ~€21,800

Autónomo wins by €3,500/year.

Case 2: Consultant earning €70,000/year

Autónomo:

Social security: €400/month × 12 = €4,800

Income tax (rough): €20,000

Gestor: €100/month × 12 = €1,200

Total tax + costs: ~€26,000

Take-home: ~€44,000

SL:

Overhead: €700/month × 12 = €8,400

Pay yourself €30,000 salary (lower IRPF bracket)

Corporate tax on €40,000 retained: €9,200

Personal tax on salary: €5,000

Total tax + costs: ~€22,600

Take-home: ~€47,400 (with €31,000+ retained in company)

SL wins if you're comfortable leaving money in the company.

Case 3: Agency owner earning €150,000/year

SL is clearly better. You'd pay 47% on everything above €60,000 as autónomo. With an SL, you control the extraction timing and method.

The "I'll just keep my UK Ltd" mistake

Common plan: keep your UK company, invoice clients through it, pay yourself a low UK salary, pretend you're still UK tax resident.

Why it fails:

You're tax resident where you live. 183+ days in Spain, or your center of vital interests here, means Spanish tax residency. Your worldwide income — including what your UK company pays you — is taxable in Spain.

Permanent establishment. If your UK company's only activity is invoicing for work you do from Spain, Spain may argue the company has a permanent establishment here. That means Spanish corporate tax on profits.

HMRC and Hacienda talk to each other. CRS (Common Reporting Standard) means automatic information exchange between tax authorities. Your UK bank accounts are reported to Spain.

Penalties compound. Getting caught late means back taxes, interest, and penalties. Spain is aggressive about undeclared foreign structures.

The legal version: Some people genuinely split time between countries and have real UK business activities. That's different. But "I work remotely from Málaga for my UK company" is not a gray area — it's straightforwardly Spanish tax residency.

The decision flowchart

Are you earning over €50,000/year?

No → Autónomo. Don't overcomplicate.

Yes → Continue.

Do you need liability protection? (Clients could sue, contracts are large)

Yes → Consider SL.

No → Continue.

Are you earning over €80,000/year?

No → Autónomo probably still fine.

Yes → SL likely makes sense. Consult a tax advisor.

Do you have partners or investors?

Yes → SL. Autónomo is personal by definition.

Are you planning to sell the business eventually?

Yes → SL. Much cleaner to transfer company shares than wind up autónomo.

Spanish-lite

When meeting with a gestor about structure:

¿Me conviene ser autónomo o crear una SL? — Is it better for me to be self-employed or create a limited company?

¿ A partir de qué facturación merece la pena una SL? — At what turnover level does an SL become worthwhile?Gets you to the numbers conversation faster.

Common mistakes

Overcomplicating early: Don't create an SL until you're consistently earning €60,000+. The overhead eats your margins.

Underestimating autónomo costs: €80/month sounds manageable. €300-400/month after the discount period ends is real money if you're having a slow quarter.

Ignoring the gestor relationship: Your gestor structures your declarations. A good one saves you money. A bad one costs you more than their fee in mistakes. Interview several.

Assuming UK/US structures work: They don't. If you live here, you're taxed here. Plan accordingly.

The bottom line

For most expats starting out self-employed in Spain: begin as autónomo. The €80/month first-year discount gives you runway to build income. If you're still under €50,000/year after year two, stay autónomo. If you're over €80,000/year, get proper tax advice on an SL.

The €300/month social security baseline is real. So is the healthcare, pension, and sick leave you get for it. Whether that's a good deal depends on your income level and what you value.

Do the math for your situation. Then pick the structure that fits where you actually are, not where you hope to be.

Onwards — A

Last updated: January 2026

More guides: | | |

Get weekly insights: